Impact Investing

Investing in high-impact solutions with transformative potential

We invest in early-stage startups advancing economic mobility and resilience. Partner with us!

How We Invest

We design and manage funds offering flexible financing – such as equity, debt, and hybrid structures – connecting impact-creating startups with the right capital.

Our strategy builds on Village Capital’s tools and insights while pioneering new approaches that unlock capital for entrepreneurs – and the broader impact investing ecosystem.

By the Numbers

Our Investment Facilities

VilCap Investments

Village Capital’s inaugural global fund, which invested only in companies selected by their peers through Village Capital programs – demonstrating that peer selection can mitigate bias and surface high-potential startups.

What is Purpose-Suited Capital?

Purpose-Suited Capital is a strategic approach to investment that starts with the goal of maximizing impact and enterprise performance – and builds a growth and capital strategy around that goal. Rather than a “one-size-fits-all” model, we match the right impact capital to the right impact business. Read more about our Purpose-Suited Capital philanthropy in Impact Entrepreneur.

Investments in Action: Aquarech

Aquarech, co-founded by father-son duo David and Joseph Okech alongside James Odede, is transforming fish farming in rural Kenya – improving livelihoods and creating employment opportunities for women and youth.

All three founders hail from the home of Lake Victoria – the largest lake in Africa and the second-largest freshwater lake in the world – where they witnessed firsthand the challenges faced by small-scale fish farmers. Through Aquarech, they purchase inventory in bulk and distribute it to local farmers. But to scale their impact and support even more farmers, access to working capital became essential.

“The process of closing our seed round was quite challenging. Deciding on an amount to raise, thinking through the evaluation process, and negotiating with different investors. VilCap came in handy to provide debt to not dilute us and was kind enough to piggyback on the due diligence we provided to our equity investor,” said James Odede, Co-Founder.

Get in Touch

If you are a startup interested in future investment opportunities or if you’re interested in supporting our work, please contact our Impact Investing team.

Our Partners

Latest News

Village Capital Selects Five Entrepreneur Support Organizations in Ghana, Nigeria, and Tanzania as Venture Partners for USD 4M Africa Ecosystem Catalysts Facility

Nairobi, Kenya (July 15, 2025) – The Africa Ecosystem Catalysts Facility will channel early-stage capital into startups building local solutions for economic mobility and climate resilience.

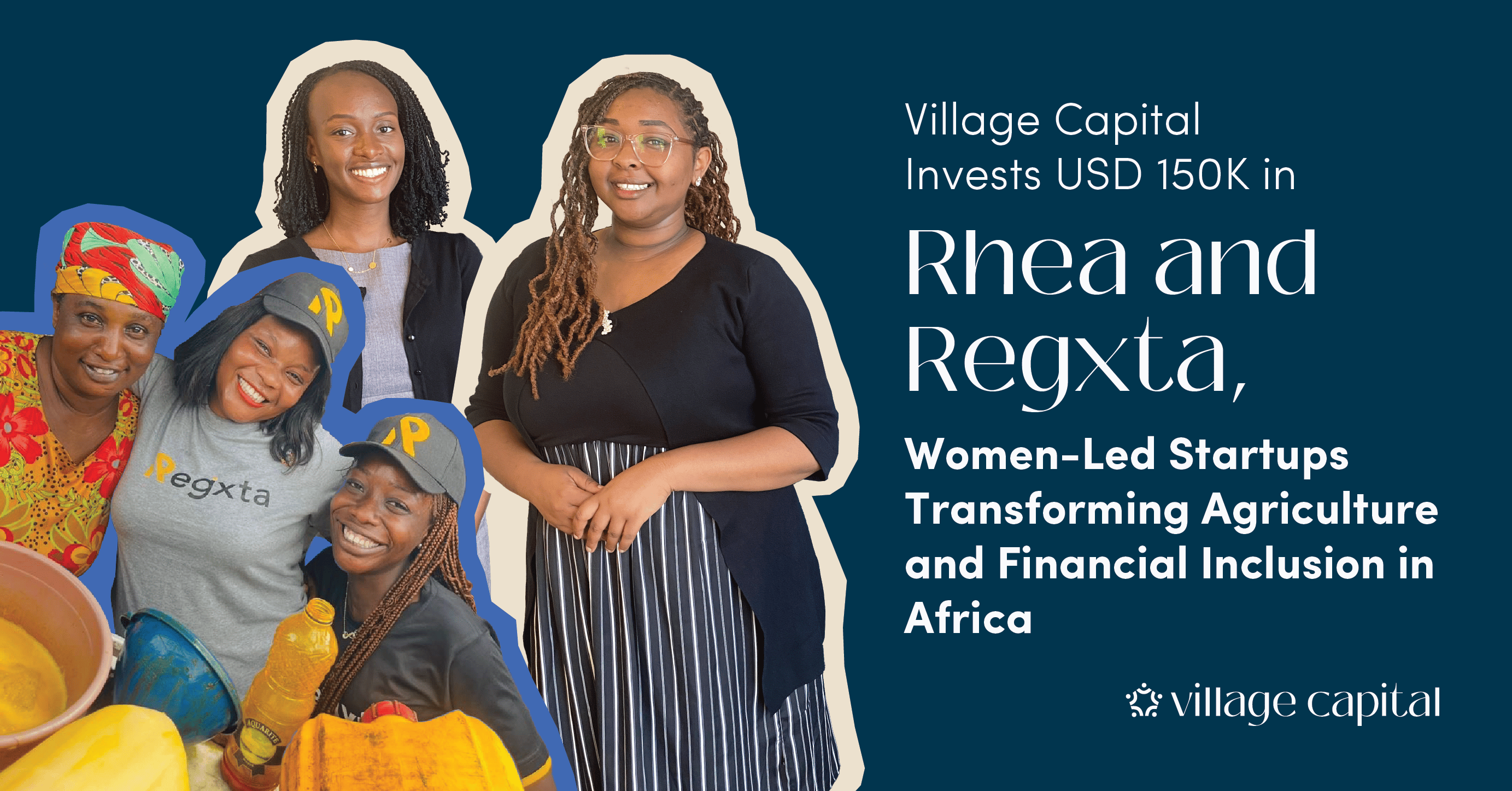

Village Capital Invests USD 150K in Rhea and Regxta, Women-Led Startups Transforming Agriculture and Financial Inclusion in Africa

Nairobi, Kenya (December 19, 2024) – Village Capital has announced its latest investments worth USD 150,000 in two innovative women-led startups, Rhea Soil Health Management (Rhea) and Regxta, through Standard Chartered’s Women in Tech Financing Facility, created to support alumni of Standard Chartered’s Futuremakers program.

Why We Invested in Ghana-Based Farmio and Pakistan-Based Closet

This blog post delves into our latest investments in Farmio, which champions climate-resilient farming in Ghana, and Closet, a second-hand fashion rental marketplace based in Pakistan, highlighting how these startups contribute to their respective countries’ environmental and economic improvements.

Limited (Be Me).png)